An interesting (and equally puzzling) thing about saving is that it’s also difficult for people who already understand its importance and benefits. When you think about that, it’s no wonder that most people don’t even bother doing it. Unfortunately, that means that the average worker usually ends the year—and for some, even their careers!—with zero. Zero balance on their accounts. Zero savings. It’s a sad reality.

The worst part about it is that what they have on hand instead is either outstanding debt, a bunch of stuff they purchased but won’t need for long, or both.

The worst part about it is that what they have on hand instead is either outstanding debt, a bunch of stuff they purchased but won’t need for long, or both.

And while there are many factors that contribute to this for sure, an obvious one is this: it’s just much easier to spend money than it is to save it.

Given the discounts and low-interest rates that our Access users have access to, we wanted to make sure they their savings from these transactions lead them to build up their savings pool, instead of being spent immediately somewhere else.

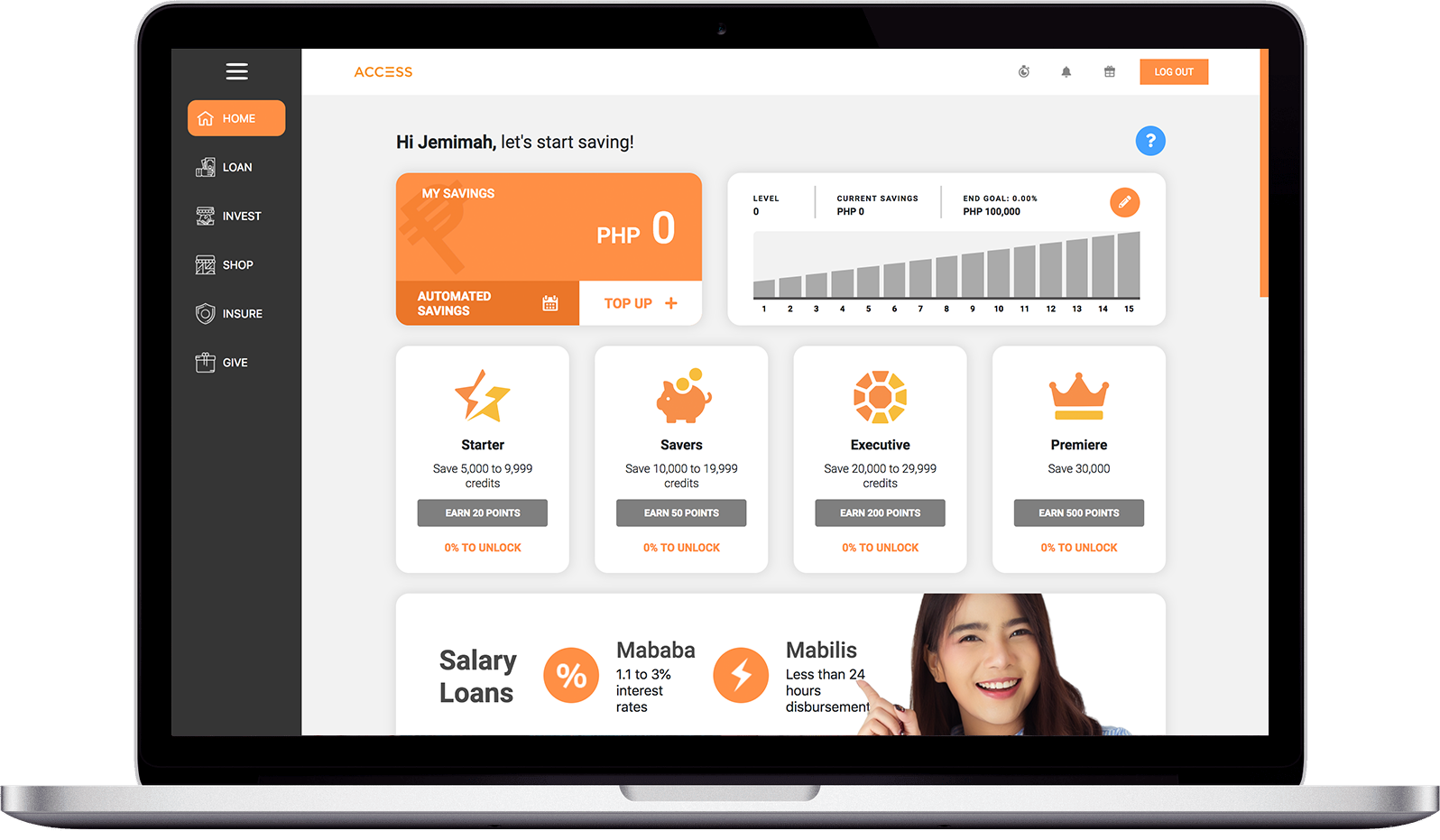

This was the thinking behind the latest changes we’ve made on Access and have been excitedly working on. These include a new user interface, the introduction of Smart Savings, and Smart Loans.

Track your Savings.

The new user interface on Access lets users see savings they accumulate with every transaction they make on Access, specifically from top-ups, smart savings, and smart loans (more on these in a bit).

Now when a user logs in to Access, they’ll immediately see their total savings on their dashboard, plus the current Access Level they’re in. As we’ve mentioned before, users get additional perks and benefits as they progress through these levels. This makes saving more exciting and easy while still allowing users to make other transactions, such as shop or loan, like they would do before.

Smart Savings and Smart Loans.

Making saving easy requires more than just a better tracker though. This is why we’ve also launched two services that help users automate their savings.

The first is Smart Savings, which allows users to choose an amount they’d like to set aside regularly from their monthly salary and automatically added to their savings. Most of us already automate our bills payment, have our government contributions automatically deducted from our salaries; others even have subscriptions to monthly services such as Netflix or Spotify. It’s time we automated savings too.

Smart Loans is our industry-lowest salary loan that’s combined with smart savings. With a Smart Loan, users are able to get as low as a 1.1% monthly interest on a loan if this is coupled with a monthly saving amount that’s set aside with every loan payment they make.

For example, a person who has a P10,000.00 12-month loan with a 10% monthly interest will be paying P1,833.33/month. With a Smart Loan, the person would only need to pay P943.33/month for his loan payments granted that he adds automatic savings. So if he were to choose to set aside P890.00/month to go with his loan payment so that he would shell out the same monthly total as a regular loan, he would have an additional P10,680.00 added to his savings at the end of his loan payments!

More to come.

We’re very excited to help make savings easier for every worker. We’ve got more to roll out including a mobile app that’s currently in the works. Stay tuned!